Whether for new customers or transaction checks, Digital KYC can be experienced with smart assistants and API connection.

Benefit from the online platform and the simple checks, detailed reports and automated identification processes.

KYC Spider is subject to strict Swiss data protection laws. The servers are located in Switzerland, protected by Swiss banking standards.

DO YOU HAVE A SPECIFIC QUESTION?

Anonymous transactions involving large sums of money represent a major risk

In the area of Fintech, Blockchain, ICO or STO companies, the often anonymous transactions with sometimes very high transaction values represent a high risk factor in the areas of embezzlement, money laundering, the arms trade and terrorist financing. Therefore, Fintech companies take certain regulatory measures to verify their transactions and prevent money laundering.

Regulatory Standards for Fintech Institutes in Switzerland and Europe

From January 2019, the Swiss Parliament has created a new authorisation category - the so-called Fintech authorisation - in the Banking Act. The approved Fintech institutions are therefore also subject to the Anti-Money Laundering Act (AMLA) as are all other financial intermediaries. To this end, Fintech in Switzerland must take preventive measures such as KYC checks in accordance with FINMA recommendations.

Previously, the European Parliament and the European Central Bank set new regulatory standards for Fintech companies in 2017. The Commission has identified a high vulnerability of financial products and services to money laundering and terrorist financing. To this end, Fintech needs to prepare a risk analysis to identify and analyse its clients in order to combat money laundering and terrorist financing in the EU. The AML Directive requires Fintech companies to identify their users before a transaction can be made.

KYC is not only there for regulation, but can also bring a competitive advantage

KYC screenings in the Fintech sector are not only a means of combating fraud, but can also provide a competitive advantage. Because more transparency and security lead to more trust and thus a higher acceptance of crypto currencies, especially in crypto transactions. This allows crypto technology to develop further and open up new markets.

Digital compliance solution for simple, fast and secure KYC screenings

KYC Spider's comprehensive online KYC toolbox for automated business partner verification provides a platform-based solution that can be tailored to Fintech's needs. With the dedicated API, you can have your KYC screenings automated and processed in near real-time. You can save your KYC data in the toolbox for a Full Audit Trail.

Learn below how you can benefit from Digital Compliance and simplify your everyday work with the Toolbox. Or download our free summary for KYC managers at Fintech companies:

KYC stands for "Know Your Customer" and is an important tool for banks and Fintech in particular to verify the legitimacy of their customers and transactions.

KYC stands for "Know Your Customer", KYB for "Know Your Business", and they are an important tool for banks and Fintech in particular to verify the legitimacy of their customers and transactions. The main objective of KYC Compliance is to prevent money laundering and white-collar crime.

Companies that fail to enforce KYC's current guidelines to prevent these and other offences must prepare for legal consequences or fines.

The KYC checks are, so to speak, your defence against financial crime. In addition to money laundering or terrorist financing, illegal activities such as bribery and tax evasion are also taken into account. Companies that fail to enforce KYC's current guidelines to prevent these and other offences may be fined or prosecuted.

With our KYC Expert Service, we are at your side as your partner.

Our system relieves you of the work you don't have time for. Our compliance system takes care of your compliance, KYC processes and concerns based on the compliance process (compliance concept) defined with you and initiates further steps. With the API connection you can quickly and automatically send your (potential) customer data to our system for verification. In your toolbox, you can access the results at any time in the form of KYC/AML documentation and make FINMA- or SRO-compliant decisions based on them.

Most Fintech, STO or ICO start reviewing their users by simply gathering data and information about their potential customers.

Most Fintech, STO or ICO start reviewing their users by simply gathering data and information about their potential customers. This can be a KYC check for a legal or natural entity. Once the data has been collected, an electronic identity check is started in accordance with the relevant regulatory requirements.

For an extended due diligence, in addition to the KYC check and identification, your business partner can be checked for other risk factors in an Enhanced Due Diligence (EDD) report, if this is necessary according to your regulatory requirements.

Using the various KYC Toolbox functions, you can access these data sets online and save the results for your customer in your Toolbox.

We collect and update compliance relevant data on a daily basis to give you easy access to the current database. Using the various KYC Toolbox functions, you can access these data records online and save the results for your customer (in the form of a report) in your Toolbox. You can access your customer's KYC file online at any time and update and complete the data.

With the KYC Toolbox, you can access compliance-relevant information to check your business partners.

With the KYC Toolbox, you can access compliance-relevant information to check your business partners. The data is updated daily and is subject to strict Swiss data protection. Thanks to the server location in Switzerland, the increased security requirements according to banking standards are also met.

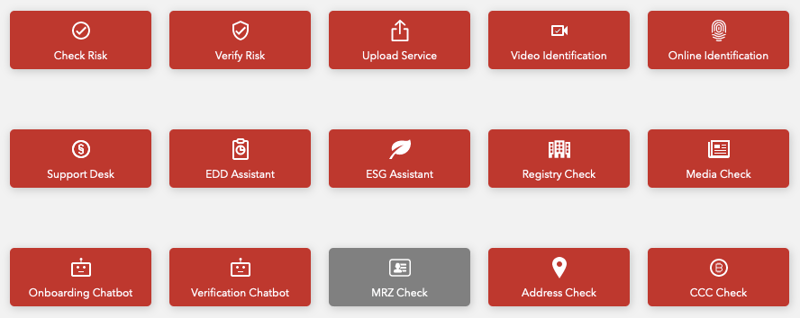

The following due diligence analysis tools are available to you for handling your KYC processes:

With a Digital KYC solution like the KYC Toolbox and the KYC Expert Service, you can verify the identity of your customers at different levels.

With a Digital KYC solution like the KYC Toolbox and the KYC Expert Service, you can verify the identity of your customers at different levels:

Enhanced Due Diligence (EDD) stands in connection with Compliance for "Enhanced Due Diligence" and means an in-depth examination of new as well as existing customers. This involves determining whether there is an increased risk of money laundering, corruption, bribery, arms trafficking or terrorist financing.

With an in-depth KYC review, you can check your contacts for involvement in criminal activities.

With an in-depth KYC review, you can check your contacts for involvement in criminal activities. With the KYC Toolbox Enhanced Due Diligence Assistant, you can check whether your customers can be connected to drugs, military, weapons, financial crime, corruption or tax fraud, environmental offences, organized crime, radicalism or terrorism, judicial or criminal proceedings.

We use data records from our own database and various other compliance relevant sources to check your customers.

We use data records from our own database (KYC Records), from the Swiss Official Gazette of Commerce (SHAB) of OpenCorporates and various online media to check your customers.

The following national and international sources are used to enrich the data in KYC Records

The following national and international sources are used to enrich the data in the KYC Records:

You can either start your KYC analysis in the KYC Toolbox manually by entering your customer data or start the KYC checks automatically via a data import via API.

You can either start your KYC analysis in the KYC Toolbox manually by entering your customer data or start the KYC checks automatically via a data import via API.

All analyses and checks you start are clearly stored in the KYC Toolbox in the KYC file of the entity. You can access, update or download the complete KYC analysis online at any time.

Digital compliance offers you a simple, fast and secure solution for checking your business partners, customers and users of your services.

Digital compliance offers you a simple, fast and secure solution for checking your business partners, customers and users of your services. You can get the most out of Digital KYC by automating the entire process with our Technical Expert Service. In general, you benefit from using the KYC platform:

Standardised and automated due diligence processes

With the functions of the KYC Toolbox, you can automate a large part of your KYC processes and quickly and easily manage or restart them online. The KYC documentation and your audit trail are available for download at any time.

Simple, fast and individual use

The KYC Toolbox is easy to use and individually usable. This way you can use the KYC functions you need and benefit from our intelligent chatbot, which we can adapt to your compliance forms and processes.

Secure data location and high data protection standard

KYC Spider stores the data on a server located in Switzerland, which meets the highest security requirements for data protection.

Access to international and current compliance relevant data

You can rely on our current data records to check your customers/users. We compile our data (KYC records) from national and international sources and update the data records daily for you.

KYC Spider is not a financial intermediary and not subject to the requirements of the AMLA. KYC Spider has developed an information platform to support financial intermediaries in fulfilling their due diligence obligations. KYC Spider is a technical service provider for data and document management.

KYC Spider will not provide any legal, regulatory, economic, financial, tax related, organizational, technical or other advice to the client.

Address

Eurospider Information Technology AG

Winterthurerstrasse 92

8006 Zürich

Phone

Contact

Eurospider offers all the necessary compliance services relevant not only for finance intermediaries, banks and insurance, but also for fintechs, casinos and industrial corporations: Embargo, sanctions screening, PEP and crime check and compliance documentation.

Eurospider Information Technology AG

Winterthurerstrasse 92

8006 Zürich

Schweiz