SECURE AND EFFICIENT KYC AND

COMPLIANCE PROCESSES FOR CASINOS AND

GAMING PROVIDERS

(TERRESTRIAL AND ONLINE)

The KYC Toolbox offers you what you need. Whether it's AMLA-compliant KYC checks, detailed reports including media screening or remote identification.

Stay informed about your business partners' inputs from various sources in near real-time with KYC Spider.

KYC Spider is subject to strict Swiss data protection. The servers are located in Switzerland and are protected according to Swiss banking standards.

DO YOU HAVE A SPECIFIC QUESTION?

Following the financial crisis of 2007, compliance requirements have risen sharply in Switzerland. The Swiss Financial Market Supervisory Authority FINMA and various self-regulatory organisations (SROs), such as the VQF (Association for Quality Assurance in Financial Services), introduced stricter due diligence requirements and controls.

Supervision of Swiss casinos is among the strictest in the world

The Swiss Federal Gaming Board (ESBK) is the supervisory authority for casinos. The ESBK and cantonal authorities carry out over 100 inspections of casinos every year. The inspections examine the effectiveness of measures against gambling addiction and money laundering, as well as the correct operation of gaming operations, electronic control systems and video surveillance.

No money laundering

Like banks, casinos and gambling providers must ensure that they are not misused to channel funds of criminal origin into the legal financial circuit and thus conceal their origin. Casinos are subject to the Anti-Money Laundering Act. Compliance with the due diligence requirements is monitored by the Swiss Federal Gaming Board (ESBK). The self-regulatory organization SRO Casinos advises the affiliated casinos and trains their staff.

Find out below how you can benefit from Digital Compliance and use the Toolbox to simplify your due diligence and use it efficiently for risk analysis. Or download our free summary for Compliance Managers:

KYC stands for "Know Your Customer" or "Know Your Client" and is an important tool for the financial sector in particular to check the identity of its customers with regard to compliance (sanction lists, PEP status, CRIME, blacklists or watchlists).

KYC stands for "Know Your Customer" or "Know Your Client" and is an important tool for the financial sector in particular to check the identity of its customers with regard to compliance (sanction lists, PEP status, CRIME, blacklists or watchlists). KYC is part of the Simplified Due Diligence (SDD) of financial intermediaries as part of a compliance process. It is operated with the aim of preventing white-collar crime or money laundering.

For casinos in Switzerland, KYC checks before the start of a customer relationship are a means of fulfilling the regulatory requirements of ESBK . It checks whether customers are trustworthy based on suspicious transactions or hits on a risk list (e.g. sanctions lists or PEP lists).

Enhanced Due Diligence (EDD) is part of the KYC process and reviews potential business partners and customers in depth for risks.

Enhanced Due Diligence (EDD) is part of the KYC process and reviews potential business partners and customers in depth for risks. EDD can assist if an increased risk has been identified during a KYC check or if the customer is carrying out risky transactions that suggest money laundering, fraud, tax evasion or terrorist financing.

In simple terms, an EDD process collects relevant and more detailed information on entities. A simple KYC check and CDD identification verification provides the basis for risk assessment.

KYC policies consist of Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD). While CDD comprises the identification and ongoing monitoring of customers, EDD reports are used to collect and evaluate additional information on the entities that have received a high risk rating in the CDD/KYC checks.

Thus it can be simplified said that an EDD process collects extended compliance relevant and more detailed information on entities. A simple KYC check and CDD identification verification within the framework of CDD provide the basis for risk assessment.

Basically, customer verification starts with the simple collection of data and information about the entity. This can be a KYC check for a natural or legal person.

Basically, customer verification starts with the simple collection of data and information about the entity. This can be a KYC check for a natural or legal person. FINMA recommends that banks start the identification process for their customers after the first KYC check. In addition, banks and regulated financial intermediaries should conduct an in-depth review of their business partners as part of an Enhanced Due Diligence (EDD) report.

After you have collected the data about your customer, it is a matter of checking your customer for risk factors and therefore compliance relevant information.

After you have collected the data about your customer, it is a matter of checking your customer for risk factors and therefore compliance relevant information.

Due to the expansion of the various KYC checklists around FATCA, AIA and MiFID controls, the manual KYC check is becoming more and more difficult. You will need to search through various sanctions lists, PEP lists, CRIME lists, and other sources of compliance-relevant data. That's why there are now more and more platforms that simplify your manual processes and controls with aggregated data sets and systematic KYC checks.

We collect and update compliance relevant data on a daily basis to give you easy access to an up-to-date database. Using the various KYC Toolbox functions, you can access these data records online and save the results for your customers (in the form of a KYC Report) in your KYC Toolbox or CRM.

With our KYC Toolbox, we offer you an intelligent ComplianceTech platform on which you can easily, quickly and securely check and identify your business partners and customer base online, as well as create detailed Enhanced Due Diligence (EDD) reports on your potential customers.

With our KYC Toolbox, we offer you an intelligent ComplianceTech platform on which you can easily, quickly and securely check and identify your business partners and customer base online, as well as create detailed Enhanced Due Diligence (EDD) reports on your potential customers.

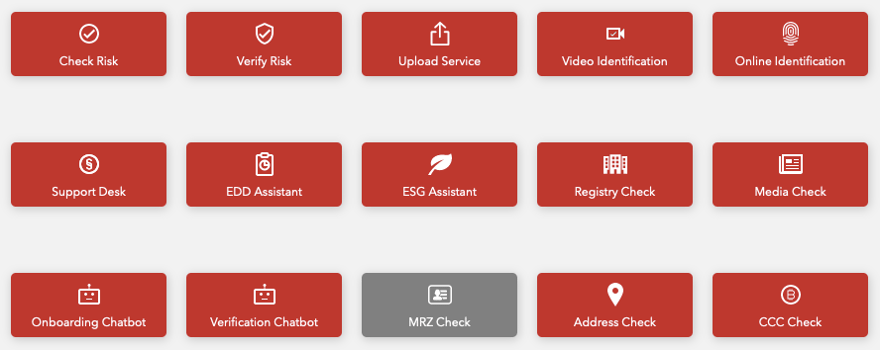

The following due diligence analysis tools are available for handling your KYC processes:

In a KYC check, your entity is checked against the following criteria:

Today, banks and regulated financial intermediaries, such as leasing companies or asset managers, must conduct such a simplified risk assessment, a Simplified Due Diligence (SDD) check, in order to be informed about possible involvement of natural or legal persons with money laundering or corruption or other criminal activities.

With KYC solutions such as the KYC Toolbox, you can verify and verify the identity of your customers at various levels:

With KYC solutions such as the KYC Toolbox, you can check and verify the identity of your customers at various levels:

Enhanced Due Diligence (EDD) stands in connection with Compliance for "Enhanced Due Diligence" and is the in-depth examination of new as well as existing customers/entities.

Enhanced Due Diligence (EDD) stands in connection with Compliance for "Enhanced Due Diligence" and is the in-depth examination of new as well as existing customers/entities. With the KYC Toolbox EDD Report, you can check whether your customers are connected to drugs, military, weapons, financial crime, corruption or tax fraud, environmental crime, organized crime, radicalism or terrorism, legal or criminal proceedings.

At KYC Spider, we use our own PEP and Sanctions database (KYC Records) to verify your customer data, as well as our own ...

At KYC Spider, we use our own PEP and Sanctions database (KYC Records), as well as data from the Swiss Official Gazette of Commerce (SHAB), OpenCorporates and various freely available online media to check your customer data.

The KYC Records database is continuously updated and accesses public compliance relevant lists and data on sanctions lists and terror lists, PEP (politically exposed persons) lists and additional compliance relevant information (CRIME).

The KYC Records database is continuously updated and accesses public compliance relevant lists and data on sanctions lists and terror lists, PEP (politically exposed persons) lists and additional compliance relevant information (CRIME).

In the following overview you can see which international organizations we have sanction, terror, CRIME and embargo lists from in our KYC Records database.

A KYC record is a profile of an entity, which is created in our database "the KYC records".

A KYC record is a profile of an entity that is created in our database - the so-called KYC records. Such a profile may contain the following elements:

Data of a natural person

Data of a legal person

Onboarding for new customers in the financial sector is usually a standardized process, but it requires a lot of manual work and often also entails a high potential for errors and delays.

Onboarding for new customers in the financial sector is usually a standardized process, but it requires a lot of manual work and often also entails a high potential for errors and delays.

Automate your onboarding with our KYC Onboarding Chatbot. We process the data automatically and integrate it seamlessly into your KYC documentation. Your compliance forms can be generated automatically with one click, based on the data from onboarding. By default, the VQF forms are stored in the KYC Toolbox.

Your advantages of the intelligent onboarding chatbots are obvious:

A PEP is a politically exposed person who exercises or has exercised a public function.

A PEP is a politically exposed person who exercises or has exercised a public function. It is recommended to prepare an Enhanced Due Diligence Report as PEPs represent a higher risk business party with regard to corruption, embezzlement and bribery than if no PEP categorisation is available.

Digital compliance offers you a simple, fast and secure business partner verification solution.

Digital KYC offers you a simple, fast and secure business partner verification solution. You benefit above all from this:

Optimisation and automation of your due diligence processes

With the Toolbox functions, you can automate a large part of your KYC processes and handle them online.

Access to daily updated compliance relevant data from all over the world

You can rely on our current data records to check your customers. We continuously collect and update our data for you from national and international sources.

Simple, fast and individual use

The KYC Toolbox is easy to use and individually usable. This way you can use the KYC functions you need and benefit from our intelligent chatbot, which we can adapt to your compliance forms and processes.

Secure data location in Switzerland with high data protection standards

We store data on a server located in Switzerland, which meets the high security requirements of banks and financial intermediaries for data protection.

KYC Spider is not a financial intermediary and not subject to the requirements of the AMLA. KYC Spider has developed an information platform to support financial intermediaries in fulfilling their due diligence obligations. KYC Spider is a technical service provider for data and document management.

KYC Spider will not provide any legal, regulatory, economic, financial, tax related, organizational, technical or other advice to the client.

Address

Eurospider Information Technology AG

Winterthurerstrasse 92

8006 Zürich

Phone

Contact

Eurospider offers all the necessary compliance services relevant not only for finance intermediaries, banks and insurance, but also for fintechs, casinos and industrial corporations: Embargo, sanctions screening, PEP and crime check and compliance documentation.

Eurospider Information Technology AG

Winterthurerstrasse 92

8006 Zürich

Schweiz